|

Getting your Trinity Audio player ready...

|

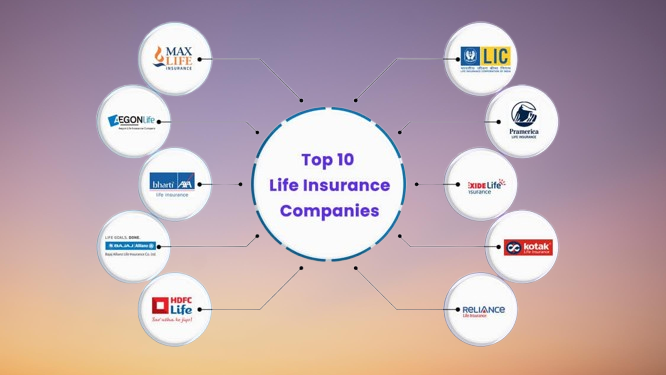

Best Life Insurance Companies for June 2025 : As of June 2025, here are the top 10 life insurance companies in India, ranked based on their Claim Settlement Ratio (CSR), Solvency Ratio, and Assets

Under Management (AUM). These metrics reflect the insurers’ reliability, financial health, and market presence: https://ctsdigital.in/

Best Life Insurance Companies for June 2025

🥇 Top 10 Life Insurance Companies in India – June 2025

| Rank | Company Name | CSR (%) | Solvency Ratio | AUM (₹ Crore) | Notable Features |

|---|---|---|---|---|---|

| 1 | Axis Max Life Insurance | 99.65 | 2.1 | 1,47,427.80 | Highest CSR; extensive product range; strong digital infrastructure. |

| 2 | HDFC Life Insurance | 99.50 | 1.9 | 2,87,136.23 | Comprehensive portfolio; strong digital presence; high solvency ratio. |

| 3 | ICICI Prudential Life | 99.17 | 1.9 | 2,86,820.29 | Transparent policies; AI-powered claim settlement; flexible premium options. |

| 4 | Max Life Insurance | 99.34 | 1.8 | 1,47,427.80 | High CSR; innovative insurance products; flexible policy terms. |

| 5 | Bajaj Allianz Life | 99.23 | 4.5 | 1,07,800.42 | Strong solvency ratio; diverse product offerings; competitive premiums. |

| 6 | Kotak Mahindra Life | 98.29 | 2.6 | 79,227.23 | High solvency ratio; customizable plans; strong financial stability. |

| 7 | Aditya Birla Sun Life | 98.07 | 1.8 | 85,763.04 | Cost-effective term insurance; flexible payment options; strong claim settlement ratio. |

| 8 | Tata AIA Life Insurance | 99.13 | 1.8 | 96,897.23 | High CSR; comprehensive product range; strong digital infrastructure. |

| 9 | PNB MetLife India | 99.20 | 1.7 | 47,420.06 | Competitive pricing; flexible premium payment options; strong financial security. |

| 10 | SBI Life Insurance | 98.25 | 2.2 | 3,85,094.99 | Backed by India’s largest public sector bank; affordable term insurance; extensive branch network. |

जून 2025 की टॉप 10 सर्वश्रेष्ठ जीवन बीमा कंपनियाँ

📊 #Best Life Insurance Companies Key Metrics Explained

- Claim Settlement Ratio (CSR): Indicates the percentage of claims settled by the insurer, reflecting its reliability.

- Solvency Ratio: Measures the insurer’s ability to meet long-term obligations; a ratio above 1.5 is considered healthy.

- Assets Under Management (AUM): Represents the total market value of assets managed by the insurer, indicating its market presence.

🔍 #Best Life Insurance Companies Additional Insights

- Life Insurance Corporation of India (LIC): While LIC’s CSR stands at 98.52%, it leads in AUM with ₹44,23,579.33 crore, highlighting its dominant market position.

- Bajaj Allianz Life Insurance: Boasts the highest solvency ratio at 4.5, ensuring robust financial health.

- SBI Life Insurance: With a CSR of 98.25% and an AUM of ₹3,85,094.99 crore, it combines trust with extensive reach.

✅ Recommendations

- For High Claim Settlement Assurance: Consider Axis Max Life Insurance or HDFC Life Insurance.

- For Strong Financial Stability: Bajaj Allianz Life Insurance and Kotak Mahindra Life Insurance are notable choices.

- For Extensive Market Reach: SBI Life Insurance and LIC offer widespread accessibility.

- For Innovative Product Offerings: Max Life Insurance and Tata AIA Life Insurance provide diverse and flexible plans.